Pricing that works at scale.

Competitive rates for every business size, from high-volume payouts to small transactions. Pricing scales with your growth and adapts across industries like rent, tuition, and payroll.

Many platforms simply transfer funds. Ours does more; it helps you track transactions, protect profit margins, and gain insights to keep your business running smoothly.

Make Every Payment Feel Instant

Flexible Pricing That Scales With You

Choose from transparent fixed rates of 2.75% + $0.15 per transaction or an interchange-plus model.

Designed for businesses that process frequent or high-value transactions.

Built to support a wide range of service models without locking you into a one-size-fits-all plan.

Built to Fit Your Stack

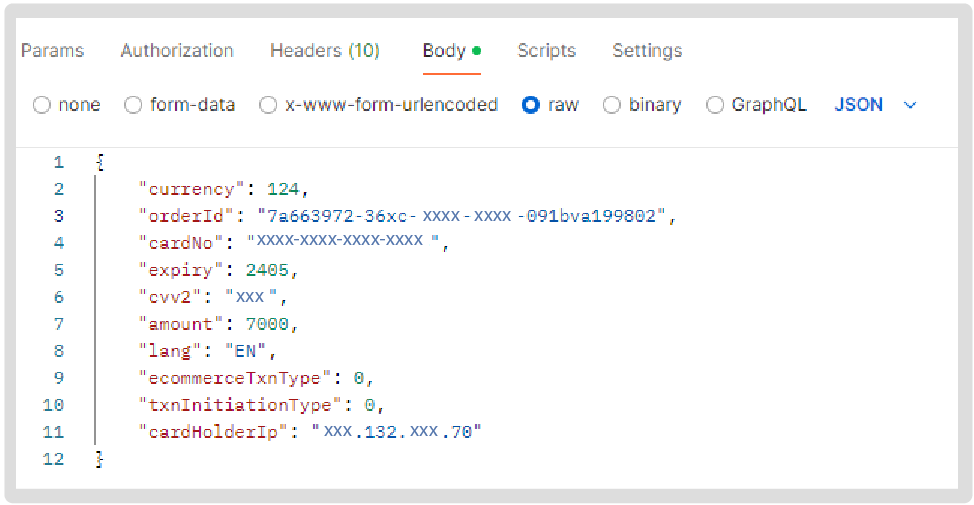

Comprehensive API suite enables quick integration with minimal overhead

Sandbox testing environment lets you safely build and deploy.

Clear documentation and direct support from our Canadian-based team whenever you need assistance

PCI-DSS compliance, fraud detection, and end-to-end encryption included. You’ll have clear documentation and Canadian-based support when needed.

DC Payments offers comprehensive solutions for accepting payments, whether online, in-person, or via an existing platform. Our system seamlessly integrates support for cards, Interac e-Transfer®, digital wallets, and more, eliminating the need for patchwork tools.

-1-1.png)

For teams that need flexibility without the bloat.

Developer-first APIs built for clean integrations

Works with new or existing systems.

Includes recurring billing, invoicing, refunds/disputes, and payout scheduling.

Clear docs, fast setup, real support when needed.

Turns any Android phone into a tap-to-pay device (iOS available soon!)

No hardware rentals, terminals, or dongles

Great for teams on the move: contractors, clinics, mobile professionals

Plug-and-play integrations with the tools you already use.

Shopify

QuickBooks

Salesforce

Zoho

.png)

Transparent pricing, no monthly fees.

per month

(no setup fees)

per Visa® / Mastercard® transaction

per completed Interac e-Transfer request + 35 bps (max $3.50)

per completed transaction

(up to $3.50 max)

Competitive rates for every business size, from high-volume payouts to small transactions. Pricing scales with your growth and adapts across industries like rent, tuition, and payroll.

Our Canadian team expertly manages your entire payment process, from billing and appointment deposits to refunds, chargebacks, and payouts.

Partnered with Digital Commerce Bank, ensuring compliance and stability. Funds are processed through a federally regulated financial institution.

With DC Payments, you gain a reliable partner. Our dedicated team is here to support you every step of the way, making setup effortless and ensuring seamless integration, so you can keep your business running smoothly.

Tell us how payments fit into your business. We’ll ask the right questions to highlight what matters most.

See exactly how your payments will flow, what’s needed to go live, and where we’ll support you.

Work with a dedicated contact who guides you from start to finish, without the endless back-and-forth.

We’ll handle deployment and stay by your side afterward. If anything comes up, you can reach our team at any time.

* The INTERAC logo and INTERAC e-Transfer are registered Trade-marks of Interac Corp. Used under licence.

* Le logo INTERAC et Virement INTERAC sont des marques déposées d’Interac Corp. Utilisées sous licence.