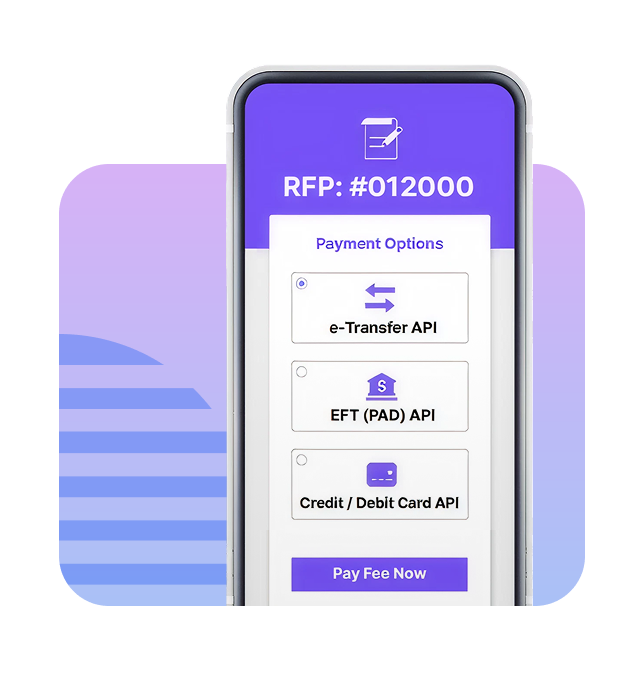

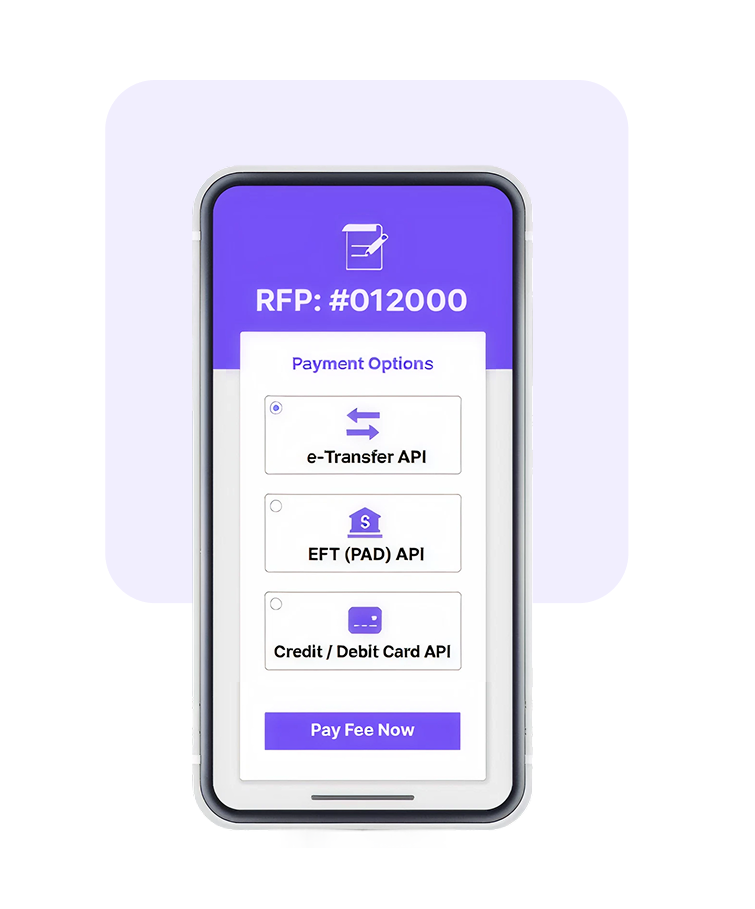

See the power of integrated payments for your proposals software.

DCPayments offers a frictionless experience so you can collect fees on time every time.

Looking for a Payments Solution for your software?

We can help!

Book a demo to see how our customized solutions are as versatile as your business needs.ω

Loading...

Payment Options for Invoices

Your software could benefit from these additional payment options

Interac

Cards and Card

Processing

Electronic Funds

Transfer (EFT)

Invoice Payment Made Easy:

Clients can pay invoices seamlessly through their preferred method directly within your proposal platform (credit card, debit, bank transfer, etc).

Clients can pay invoices seamlessly through their preferred method directly within your proposal platform (credit card, debit, bank transfer, etc).

Automatic Invoicing:

No more manual matching of payments with outstanding invoices. Proposal fees are reconciled instantly, saving time and reducing errors.

No more manual matching of payments with outstanding invoices. Proposal fees are reconciled instantly, saving time and reducing errors.

Reduced Payment Friction:

Streamlined payments can lead to fewer late payments and reduced client churn.

Streamlined payments can lead to fewer late payments and reduced client churn.

Enhanced Data Security:

Secure payment processing protects both you and clients, reducing the risk of fraud.

Secure payment processing protects both you and clients, reducing the risk of fraud.

Centralized Financial Management:

Track all financial transactions within your proposal software – one dashboard for everything.

Track all financial transactions within your proposal software – one dashboard for everything.

Secure and Easy Connection:

Connect easily via secure API or SFTP. API business payment solutions are highly intuitive, simple to use, and easily integrated into your current system.

Connect easily via secure API or SFTP. API business payment solutions are highly intuitive, simple to use, and easily integrated into your current system.

Limited Options:

Clients may be limited in payment methods, leading to collection delays and administrative headaches.

Clients may be limited in payment methods, leading to collection delays and administrative headaches.

Manual Processes and Errors:

Manually handling proposal fees increases the risk of mistakes and time-consuming reconciliations.

Manually handling proposal fees increases the risk of mistakes and time-consuming reconciliations.

Delays in Proposal Availability:

Paper-based payments slow down cash flow and can cause budgeting issues.

Paper-based payments slow down cash flow and can cause budgeting issues.

Potential for Late Payments:

If invoice payment is inconvenient, you may experience more late fees and strained relationships.

If invoice payment is inconvenient, you may experience more late fees and strained relationships.

Vulnerabilities in Payment Handling:

Outdated payment processes leave sensitive client data more susceptible to security risks

Outdated payment processes leave sensitive client data more susceptible to security risks

Manual and Less Secure Connections:

Without a secure API or SFTP, connections may be less secure and more difficult to manage.

Without a secure API or SFTP, connections may be less secure and more difficult to manage.

Connect Easily Via Secure API Or SFTP

API business payment solutions are highly intuitive, simple to use, and easily integrated into your current proposal software, but they are also secure. We utilize secure APIs and SFTPs to ensure safe and encrypted access, transfers, and management, enabling you to have complete peace of mind for all invoice payments.

Manage Contract/

Renewals

Bulk/Manually

Upload Information

Manage Payments/

Late Payments

Manage Tenants

Communications

ERP Integrations

Communications